By Stacey Tinsley, Bossier Press-Tribune

Bossier Parish students are getting a crash course in real-world finances thanks to a new initiative aimed at equipping the next generation with critical money management skills. Red River Credit Union (RRCU), in partnership with Bossier Parish School for Technology and Innovative Learning (BPSTIL), hosted the parish’s first-ever Community Reality Fair on April 7 — a hands-on, immersive experience designed to teach high school students the realities of budgeting, spending, and financial planning.

After a successful decade of hosting similar events across Texas, where thousands of students have benefited, RRCU has brought the financial literacy-focused program to Northwest Louisiana for the first time. The fair, organized in collaboration with Bossier Parish School administrators and BPSTIL staff, saw up to 819 students navigating mock financial decisions, all while trying to stay within their budgets.

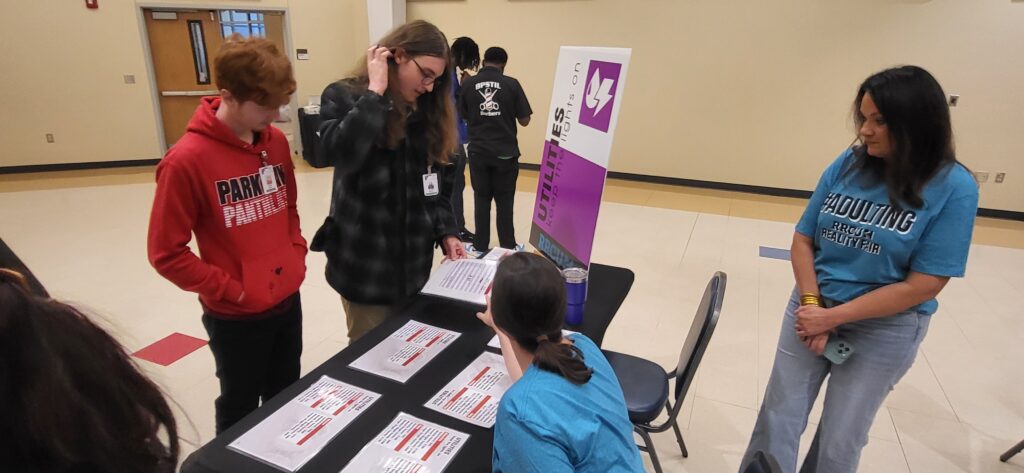

Much like a career fair, the Community Reality Fair featured industry tables staffed by volunteers from nine local businesses, representing areas such as housing, transportation, insurance, meals, clothing, entertainment, technology, utilities, and personal care. However, instead of applying for jobs, students were assigned hypothetical salaries and tasked with managing expenses — from rent and groceries to unexpected credit card payments.

“This event isn’t just about numbers — it’s about decisions,” said Brandi Falting, RRCU Commercial Development and Lending Officer. “Students get to experience, in a fun and eye-opening way, how fast money goes and how important budgeting really is.”

The simulation drives home key financial principles that RRCU hopes students will carry with them beyond high school: the true cost of living, the importance of budgeting, and the value of saving. According to national data, 40% of Americans can’t cover a $400 emergency without borrowing money or selling something — a statistic RRCU is aiming to change through education.

Emily Bright, RRCU’s Financial Education Advocate in Texas, emphasized the importance of community involvement in making the program successful. “To achieve our goal, we need the support of community members! Connecting students with adults outside of their school district allows them to see that there are people in the community who genuinely care about their financial education. Further, all community members have experience in finance, whether that be buying a vehicle, buying a home, saving for retirement, etc.

Everyone has a different financial journey, and the more we share our grievances that we have been through, the more all of us learn in general.”

RRCU’s commitment to financial literacy extends well beyond the fair. Since opening its Bossier branch in October 2024, the credit union has actively partnered with community organizations and schools across the region. Their approach includes ongoing classroom presentations, workshops, scholarship opportunities, and the use of interactive tools like Greenlight and Zogo, designed to help teens and families build strong financial habits together.

The reality fair also serves as a reflection of RRCU’s foundational values as a credit union — particularly the cooperative principles of “Education, Training and Information” and “Concern for Community.” All expenses for the event were fully funded by RRCU, with 10 to 25 employees volunteering their time to assist students and ensure a smooth experience.

Educators from BPSTIL praised the event’s impact, noting how real-life simulations provide a level of understanding that textbooks often can’t. From learning the long-term consequences of credit card debt to understanding paycheck deductions, students gained a clearer picture of what adult life — and financial independence — actually looks like.

This Bossier-based rollout marks RRCU’s largest event of its kind to date and a significant step forward in promoting financial wellness among young people in the region.

Those interested in volunteering or learning more about RRCU’s financial education programs can contact [email protected] or follow the credit union on Facebook, Instagram, TikTok, and YouTube for updates and resources.

Together, RRCU and Bossier Parish are helping students make cents of their future.